In the world of global finance, the challenge of mitigating currency exchange rate risks is a critical concern for traders, investors, businesses, and policymakers. Rapid and unpredictable movement in currency prices can have a profound impact on international trade, investment decisions, and overall economic stability. The practice of currency hedging has emerged as a prominent strategy for mitigating these risks and maintaining financial stability and predictability.

Understanding Exchange Rate Volatility

Before we start discussing approaches to hedge against exchange rate volatility, we need to define what it is. Exchange rate volatility usually refers to the degree of fluctuation in the value of a country’s currency relative to another currency. It reflects how much a currency’s exchange rate can change over a specific period. To make things simpler, let’s consider a EURUSD Forex pair as an example. The EURUSD price represents how many dollars you have to pay to buy 1 EUR. Exchange rate volatility refers to the price of EURUSD changing rapidly and violently, leaving little room for a reaction from investors and traders’ side.

Several factors contribute to exchange rate volatility, such as economic indicators, geopolitical events, market speculation, and supply and demand dynamics in the foreign exchange markets (Forex). FX hedging strategies can greatly aid investors, businesses, and traders to reduce the volatility of their portfolios and lead to more predictable profit outcomes. This is super important as traders and investors in FX markets constantly face exchange rate risks, as they have to deal with the currencies directly.

For international businesses, investors, and policymakers, high exchange rate volatility can be very dangerous as it can heavily impact international trade, investment decisions, and the overall stability of an economy.

Governments and central banks employ various fiscal policies to ensure stable exchange rates and reduce volatility, vital for a healthy economic environment. Exchange rate volatility can easily lead to uncertainty and rising prices, which is never good for the economy.

Also Read – 7 Best Advantages Of Decentralized Currencies Like Bitcoin

The Need for Currency Hedging

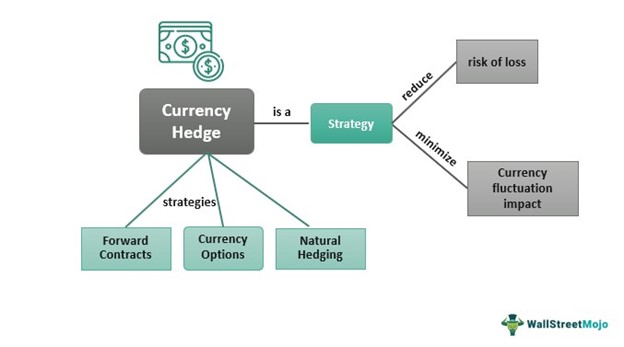

Currency hedging refers to protecting against the risks associated with currency exchange rate fluctuations. To mitigate the potential impact of currency risks, investors, and businesses employ numerous strategies. This is crucial as the currency risk can impact financial markets, portfolios, investments, and business operations. There are several reasons why hedging the currency risks is critical:

- International trade and transactions — transnational businesses and corporations engage in international trade and often deal with multiple currencies. Fluctuations in exchange rates can dramatically affect prices for goods and services when buying or selling in different currencies. Currency hedging helps mitigate these risks, providing a more stable financial environment.

- Foreign investments — investors who hold assets in foreign economies or currencies face currency risks. Exchange rate fluctuations can change the value of the assets, impacting profitability. Currency hedging is an effective way to protect international portfolio value.

- Reducing volatility — Exchange rates can be highly volatile, especially during important macroeconomic events such as news releases and central bank decision meetings. Currency hedging can reduce the impact of volatility, promoting a stable financial environment.

- Budgeting and planning — Multinational companies have to take into account potential currency rate risks as they have to deal with multiple currencies. Hedging helps them plan against potential risks more effectively and maintain low costs.

- Interest rate differentials — When two countries have different interest rates, there is an increased volatility in the exchange rates for these currencies. Currency hedging mitigates these differentials and provides countries with the ability to maintain a stable financial environment in their economies.

Also Read – What’s the Future of Cryptocurrency in the Us Under Biden’s Administration?

Common Currency Hedging Instruments

To hedge currency risks, investors, and traders have come up with strategies employing different financial instruments:

Forward contracts — Agreements to buy or sell a specified amount of currency at a future date and a predetermined price or exchange rate. These contracts are usually used by large investors to maintain a balanced financial position in the foreseeable future.

Futures contracts — Similarly to forward contracts, futures contracts also are agreements with the obligation to buy or sell the asset at a predetermined price at a predetermined date. Futures ‘ main advantage is their standardized form and availability on exchanges.

Options — The currency option provides the holder with the right but not obligation unlike futures to buy or sell a specific amount of currency at a predetermined price and date. There are two types of options: call options (buying) and put options (selling).

Currency swaps — Two parties exchange currencies for a specific time and agree to reverse the exchange at a later date. This is very useful for large corporations to ensure stability in their operations.

Forex options — Unlike currency options, Forex options are traded over-the-counter (OTC). Forex options can be adjusted to meet specific needs, which makes them very flexible.

There are many other forms developed over the years to combat the exchange rate fluctuations and their negative influence on the stability of financial environments, but these are the most popular and adopted ways.

Also Read – Forex vs. Crypto Trading: Which One Is More Profitable?

Strategic Considerations for Currency Hedging

Thoughtful planning and decision-making are required to mitigate currency exchange rate risks effectively. Here are the key strategic considerations for achieving hedging goals effectively:

Risk assessment

Identify the extent of exposure to currency risks. This can be done by analyzing historical data about your company’s financial performance. Consider both transactional and translational exposures. Calculate how the change in the exchange rate can affect the financial performance of the business, investment, or trade.

Business objectives and risk tolerance

Define risk tolerance for your organization and align currency hedging strategies with overall objectives. Different companies will have different risk appetites, and hedging decisions must reflect these preferences.

Cost-benefit analysis

Evaluate the potential impact of currency hedging on financial performance. What are the costs of implementing hedging strategies against the benefits of reduced volatility and enhanced financial predictability? Answer these questions.

Hedging instruments selection

Based on the nature of exposure, select proper hedging instruments. This is important for achieving risk management goals. Futures are better for managing long-term risks, while forward contracts are more suitable for transactional exposures.

Expertise and resources

It is vital to ensure your organization has access to enough talented experts to implement effective hedging strategies and maintain risks under control. You can collaborate with financial professionals, and currency experts, using technologies, or combinations of all the mentioned.

Carefully considering these strategic factors will help investors, traders, and businesses develop a well-thought-out plan for risk management in their organizations.